The Predictive Power of the Intelligent Credit Market

Written by the Capital Quant Team

With great data comes great predictability.

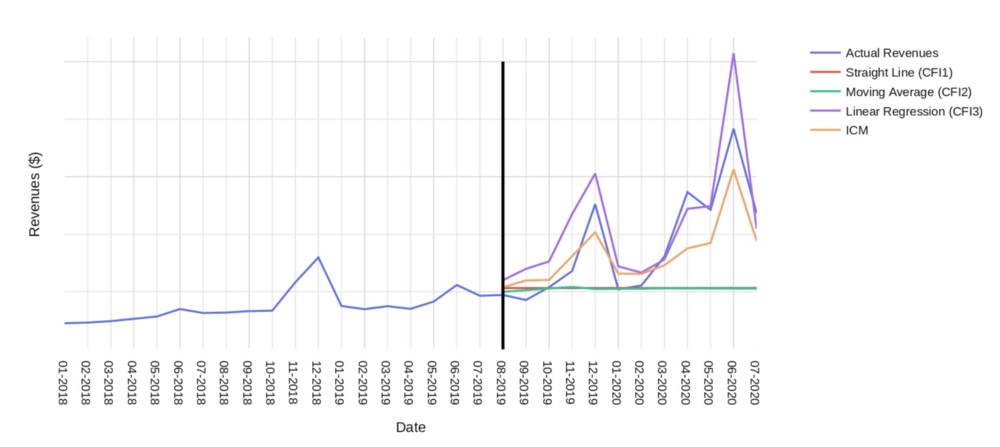

At Capital, we leverage big data to try and draw the most accurate financial picture of companies. A crucial element of this picture is the prediction of future revenues, given a company's investment plan. Granular information on each customer transaction allows the Intelligent Credit Market (ICM) to predict a company's future revenues with unprecedented accuracy. ICM's predictive power can be compared to some of the state-of-the-art revenue forecast methods, showing in general better performances for the companies in our database.

How to predict the future

The Corporate Finance Institute™ lists the most used methods for forecasting a private company’s revenues given their income statement, from drawing a straight line to regressing revenues against other known financial quantities. Having access to each individual customer transaction, we can make use of a new set of prediction methods. For example, we group customers in cohorts by acquisition period and use historical data to predict how the current customer cohorts will behave and how new cohorts will form. This type of insight greatly increases the accuracy of our predictions.

Can we trust these predictions?

We can measure the accuracy of our predictions by pretending not to have the last year of data and see how close to reality our predictions would have gotten. This procedure is usually referred to as validation. Assigning accuracy scores to different prediction methods allows us to compare them and choose the best. Not surprisingly, the method that exploits the most data (ICM) is the most accurate overall. Across all companies in our database, we achieved a median prediction accuracy of 77% on forecasted revenues.

Delve into the details by reading this white paper.